ESG Explained: A Simple Guide for Businesses in 2026

Introduction: Why ESG Matters More Than Ever

ESG is everywhere — in boardrooms, investment decisions, regulations, and customer expectations. But for many businesses, ESG still feels vague, complex, or overwhelming.

So what does ESG actually mean, and why is it becoming unavoidable?

In this guide, we break down Environmental, Social and Governance (ESG) in plain English, explain why it matters in 2025, and show how companies can approach ESG in a practical, value-driven way.

What Does ESG Stand For?

ESG stands for:

E – Environmental

S – Social

G – Governance

Together, these three pillars are used to evaluate how responsibly a company operates, beyond just financial performance.

ESG helps investors, regulators, partners and customers understand:

How a company impacts the environment 🌍

How it treats people 🤝

How it is managed and governed 🏛️

Environmental (E): How Your Business Impacts the Planet

The Environmental pillar focuses on how a company interacts with the natural world.

Key environmental ESG factors include:

Carbon emissions and climate impact

Energy efficiency and renewable energy use

Biodiversity and land use

Water consumption

Waste management and recycling

Deforestation and ecosystem protection

In 2025, environmental performance is no longer optional. With climate risk, biodiversity loss, and stricter reporting requirements, businesses are expected to measure, reduce, and disclose their environmental footprint.

🌱 This is where nature-based solutions, reforestation, and ecosystem restoration — core to CloudForests’ mission — play a critical role in credible environmental ESG strategies.

Social (S): People, Communities and Society

The Social pillar examines how a company treats its employees, customers, suppliers and wider community.

Common social ESG topics:

Employee wellbeing, safety and fair pay

Diversity, equity and inclusion (DEI)

Human rights and ethical supply chains

Community engagement and social impact

Customer trust, data privacy and product responsibility

Strong social ESG performance builds:

Higher employee retention

Stronger brand trust

More resilient supply chains

Companies that ignore social factors face reputational damage, talent shortages, and operational risk.

Governance (G): How the Company Is Run

Governance refers to leadership, transparency, and accountability at the top of an organisation.

Governance ESG factors include:

Board structure and diversity

Executive compensation

Ethical decision-making

Anti-corruption policies

Risk management and compliance

Shareholder rights and transparency

Good governance ensures that environmental and social commitments are real, measurable, and enforced — not just marketing claims.

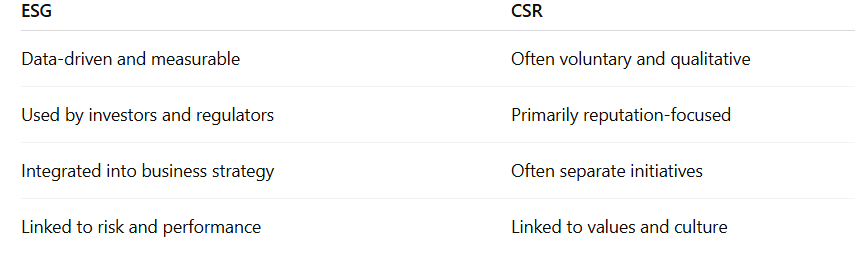

ESG vs CSR: What’s the Difference?

Many people confuse ESG with CSR (Corporate Social Responsibility).

In short:

CSR is about intention. ESG is about evidence.

Why ESG Is So Important in 2026

ESG is being driven by three major forces:

1. Regulation

New rules like the EU CSRD require companies to report ESG data with the same rigour as financials.

2. Investors

Investors increasingly assess ESG performance to:

Reduce risk

Identify long-term value

Meet their own regulatory obligations

3. Customers & Talent

Consumers and employees want to support businesses that:

Protect nature

Act ethically

Contribute positively to society

Ignoring ESG now creates financial, legal, and reputational risk.

How Businesses Can Start with ESG (Without the Headache)

You don’t need to do everything at once. A practical ESG starting point includes:

Understand your biggest impacts

Environmental, social and governance risks vary by industry.Measure what matters

Focus on meaningful, material metrics — not vanity numbers.Use credible environmental actions

Nature-based solutions, biodiversity protection, and verified climate projects strengthen ESG credibility.Be transparent

Honest reporting beats exaggerated claims. Avoid greenwashing — and greenhushing.Build ESG into strategy

ESG works best when it supports long-term business resilience.

ESG and the Role of Nature-Based Solutions

High-quality ESG strategies increasingly rely on real environmental outcomes, not just offsets or pledges.

Protecting forests, restoring ecosystems, and supporting biodiversity:

Reduces climate risk

Strengthens environmental ESG scores

Aligns with global sustainability frameworks

Creates measurable, long-term impact

🌳 This is why platforms like CloudForests exist — to connect businesses with transparent, nature-positive ESG solutions.

Final Thoughts: ESG Is About Long-Term Value

ESG is not a trend or a box-ticking exercise. It’s a framework for building resilient, responsible, future-proof businesses.

Companies that embrace ESG:

Manage risk better

Attract capital more easily

Build trust with customers and employees

Contribute to a healthier planet and society

And in 2026, that’s not just good ethics — it’s good business.